Technological revolutions often arrive with similar rhythms—early excitement, massive investment, and transformative outcomes. But no two waves are truly alike. This essay examines two pivotal innovation booms: the rise of internet companies in 1995 and the explosive growth of AI startups in 2025. By comparing key indicators—startup formation, venture funding, investor behavior, and macro trends—we can better understand how the AI surge mirrors, diverges from, and ultimately dwarfs the internet wave in both scale and complexity.

I. 1995: The Dawn of the Commercial Internet

In 1995, the internet was still a novel frontier. Browsers like Netscape Navigator had just emerged, and most households still accessed the web via dial-up. But beneath the surface, a venture capital engine was quietly igniting a revolution.

Key Stats from 1995:

- Total VC Investment (US): ~$5.9 billion

- Internet-Focused Startups: Hundreds globally; early giants like Yahoo!, eBay, and Amazon emerged

- Number of VC Firms: ~400 by late 1990s, many just starting

- Notable Rounds: Yahoo! raised $1M at a $4M valuation; Netscape IPO’d at $28 per share, surging to $75 on day one

- Market Belief: Uncertain but optimistic; investors knew change was coming but didn’t know how

Key Characteristics:

- Infrastructure-focused: Startups built the early tools—browsers, portals, search engines

- Broad experimentation: No dominant playbook existed; categories were still forming

- VC expansion: The number of firms and funds grew rapidly in response to demand

II. 2025: The Age of Applied Intelligence

Fast forward to 2025: AI is no longer theoretical. From foundational models and agents to vertical SaaS and AI-native tools, the industry is exploding in both capability and capital.

Key Stats from 2025 (H1):

- Total US Startup Funding: $162.8 billion

- AI’s Share of VC Deal Value: 64.1%

- Estimated Number of AI Companies: ~70,000 globally (~17,500 in the US)

- Mega-Rounds: 69% of AI capital went to rounds of $100M+

- Standout Deals: OpenAI raised $40B at a $300B valuation; Anthropic, xAI, Mistral, and others raised billions each

Key Characteristics:

- Massive scale: AI isn’t just one sector—it spans infrastructure, consumer, enterprise, and government applications

- Concentration of capital: Unlike 1995, funding is heavily skewed toward a few elite players

- Vertical integration: Foundational model companies, hardware partners, and distribution ecosystems are tightly linked

- Enterprise focus: While consumer AI exists, enterprise use cases dominate monetization

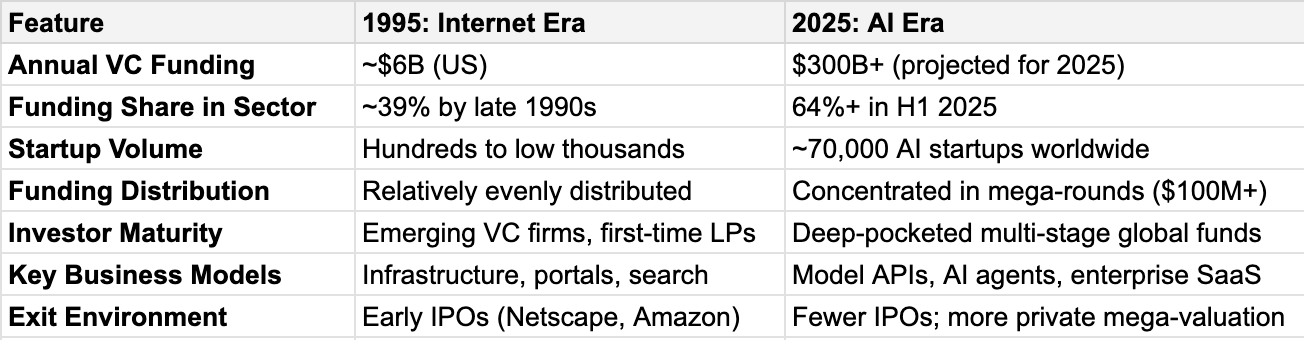

III. Comparing the Two Booms

IV. Patterns and Contrasts

1. Scale and Speed

The internet boom took years to mature. In contrast, AI’s trajectory has compressed into months. What took 5–7 years during the 90s now happens in 12–24 months. This is driven by existing infrastructure, global capital, and the internet itself enabling faster diffusion.

2. Market Knowledge

In 1995, nobody knew what would “win.” Today’s investors have decades of pattern recognition. AI founders pitch within a mature framework of traction metrics, TAM estimates, and scalability models. This compresses funding timelines and increases investment stakes.

3. Capital Concentration

Internet investing in the 90s was spread across early-stage bets. In 2025, AI funding is barbelled: massive checks go to a few model-layer giants, while long-tail builders compete for scraps. This creates a winner-takes-most landscape with fewer middle-tier outcomes.

4. Regulatory Uncertainty

Both booms faced unknowns—privacy, legality, standards. But AI enters a much more regulated, politically sensitive global environment. The speed of regulation may impact its long-term shape more heavily than the internet faced.

V. Strategic Implications for Founders and Investors

- For Founders: AI is not just a tech shift—it’s a distribution and decision-making shift. The path to value creation increasingly depends on moats around data, model fine-tuning, UX, and go-to-market execution, not just raw innovation.

- For Investors: Spray-and-pray is no longer viable. The cost of participation has skyrocketed, and follow-on rounds require deep conviction and war chests. The alpha lies in signal detection—knowing which companies are building defensible systems, not demos.

The internet boom of 1995 laid the digital foundation of modern life. The AI boom of 2025 may reshape how that life is interpreted, augmented, and optimized. While the two share some DNA—early hype, rapid capital influx, foundational uncertainty—they differ in their maturity, speed, and strategic complexity.

In 1995, we connected computers. In 2025, we’re training them to think. And the real race is just beginning.